The Chancellor of the Exchequer has little room for eye-catching generalised tax cuts: that seems to be the mood music coming from the Treasury and No.11.

With the consensus estimating that Jeremy Hunt has £13-15billion of ‘fiscal headroom’ to play with, it seems that a cut to National Insurance is the frontrunner for a headline announcement in the spring Budget tomorrow.

The Chancellor is reportedly considering a £9billion move to take another 2p off the Class 1 rate, to double down on the cut from 12% to 10% announced at the Autumn Statement and enacted in January.

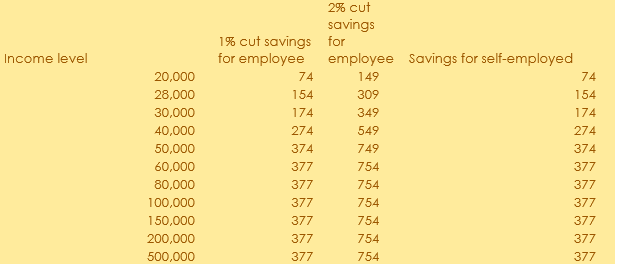

Toby Tallon, Tax Partner at Evelyn Partners, comments: “Taking a further 2p off Class 1 NICs to a rate of 8% would add £309 a year to the pay-packet of someone earning the median salary of £28,000.

“Someone earning £40,000 a year would gain £549, and employees on a salary greater than £50,270 – in other words, higher and additional rate taxpayers – would see their annual disposable income rise by £754.

“Taken together with the January cut from 12% to 10%, that would amount to an annual tax cut – compared to the situation in 2023 – of £618 for a median earner and £1,508 for higher earners, or £51.50 a month and £125.60 respectively.

“That would be a reasonably significant tax cut in isolation, but it does come against a background of rising taxation due to frozen or falling allowances and thresholds, not just for income tax but also capital gains, dividend and inheritance taxes. According to independent analysis, this Budget won’t prevent the overall tax burden rising to its highest levels since the second world war by 2028.[2]

“In a high and rising tax environment, households might want to consider whether they are using their entitlements and allowances, or perhaps where suitable making pension contributions, so they are proactively managing their own tax burden to the extent they can.

“As we near the end of the tax year when many tax exemptions, as well as ISA allowances, expire, it will pay for some households to give this some attention. Particularly salient for investors with assets outside tax wrappers, is that for the second year in a row, the capital gains tax exemption and the dividend allowance will halve on 6 April to £3,000 and £500 respectively.”

What else could be announced in Hunt’s Budget?

Tallon says, “Moves on inheritance tax and stamp duty land tax seem to be off the agenda, despite cheerleading for such moves from the Conservative back-benches. Perhaps they will find their way into the party’s manifesto instead.

“Given his restricted financial wriggle-room, Mr Hunt is reportedly looking at targeted tax rises to help fund a headline-grabbing tax cut.

“Most noteworthy, if it materializes, for many property owners would be the reported crackdown on the tax treatment of short-term holiday letting.”

Landlords who use the furnished holiday lets (FHL) regime can deduct the full cost of their mortgage interest payments from their rental income and (potentially) pay lower capital gains tax when they sell. About 127,000 properties in the UK are registered under the FHL regime.[3]

Tallon adds: “This would be presented as levelling the playing field so that short-term lets are not treated preferably to long-term rentals, and could significantly change the tax situation for many second and holiday home-owners.”

Could the Chancellor relent on the further cuts to the capital gains tax annual exemption and the dividend tax allowance that will kick in on 6 April?

Tallon says: “If Mr Hunt is looking to spring a surprise that will please his party, then maybe this could be it.

“These allowances were already halved in April 2023, from £12,300 to £6,000 in the case of the capital gains exemption, and £2,000 to £1,000 for dividends, which was quite a radical change for investors in itself.

“The two allowances are due to be halved again in April to £3,000 and £500 respectively, which really does alter the tax landscape for investors and people who run their own business compared to a couple of years ago. The dividend allowance was £5,000 as recently as 2017/18.

“It’s fair to say Mr Hunt was in a very different place when he set these policies in train at the 2022 Autumn Statement in the aftermath of the Truss-Kwarteng mini-Budget. He could be reassessing the further cuts to these allowances that are due in April, although the Budget does take place very close to the start of the next tax year.”

Calculation by Evelyn Partners (assumed 1% NIC cut for self-employed):

IFS, February 2024