With the end of the tax year fast approaching, GBI Magazine’s Jenny Hunter provides a helpful reminder of what tax-efficient investment solutions are out there for suitable clients.

It is always the case that advisers are inundated with requests from their clients on how to make the most of their tax allowances every January, February, and March. Despite the adviser’s repeated reminders and nudges to use all available allowances throughout the tax year, inevitably a lot of clients leave this until the last minute as more urgent priorities take over.

Tax-efficient investments can be a complementary solution to other financial planning, meaning that they aren’t usually the main business for many advisers, but rather come in ebbs and flows as and when a suitable client comes along, or when the tax year is coming to an end and provides a strong enough call to action.

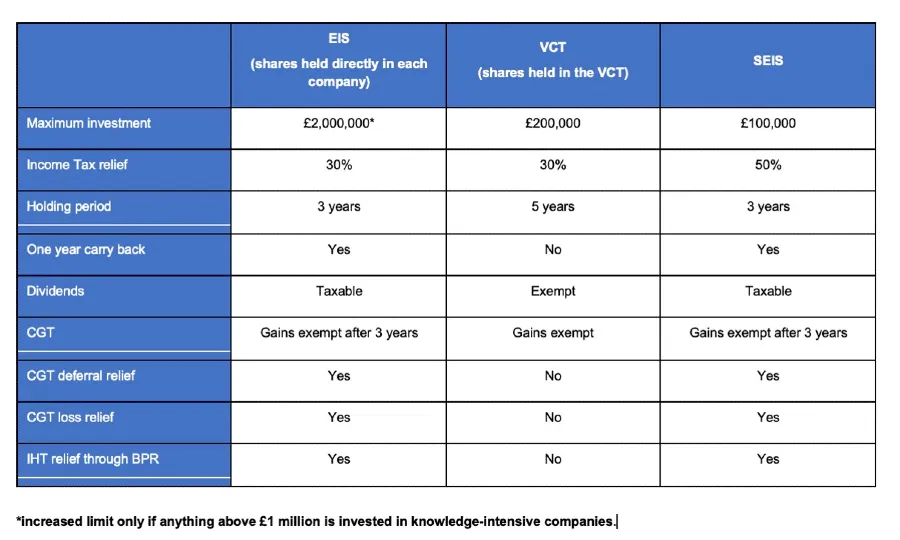

So, we thought it might be nice to provide a recap and comparison of the tax-efficient investment solutions out there, to help GBI readers be fully prepared for the tax-efficient investment inundation.

VENTURE CAPITAL TRUST (VCT)

VCT Investments are listed companies that are run by a fund manager and which, in turn, invest mainly in smaller companies that are not quoted on stock exchanges. They provide significant income tax reliefs when used correctly.

Investors must hold the VCT investment for five years or more to retain the relief, but after this time the investment could be sold if needed, with no negative effects on the previously received relief.

The tax relief on VCTs comes in several different forms and with varying risks:

- The income tax relief is 30% on a maximum investment of £200,000 per tax year when an investor buys newly issued shares. This is usually claimed back if they sell the shares within five years unless the holder was to sell them to their spouse, or they die.

- Tax relief is provided in the form of a tax credit to set against the investor’s overall income tax liability in the tax year. The amount of the tax credit cannot, therefore, exceed their total income tax liability for that tax year.

- Dividends from investments in VCTs do not attract income tax provided the original investment was made within the permitted maximum of £200,000 per year.

- You won’t have to pay any capital gains tax on gains from investments in VCTs and there is no minimum holding period for this rule to apply. But if your VCT investments make a loss, you can’t use this to reduce your capital gains tax bill from other investments. You also won’t get any CGT deferral relief if you reinvest your gains.

- VCTs do not qualify for IHT BPR and so do not get any IHT relief, meaning the full IHT rate will be payable on death.

ENTERPRISE INVESTMENT SCHEME (EIS)

EIS is designed to encourage investment in small businesses with high growth potential while providing investors with several valuable tax reliefs.

For investors seeking high growth, EIS tax reliefs provide an incentive for some of the investment risk.

- The income tax relief is 30% on a maximum investment of £1m per tax year (£2m if the extra £1m is invested in knowledge-intensive companies) when an investor buys newly issued shares. This is usually claimed back if they sell the shares within three years unless the holder was to sell them to their spouse, or they die.

- Tax relief is provided in the form of a tax credit to set against the investor’s overall income tax liability in the tax year. The amount of the tax credit cannot, therefore, exceed their total income tax liability for that tax year.

- Tax is payable on any dividends at the investor’s marginal rate.

- You won’t have to pay any capital gains tax on gains from investments in EIS as long as you have held them for the minimum holding period of three years. But if your EIS investments make a loss, you can get loss relief per company if that company fails.

- CGT deferral of up to 100% of reinvested gains, applies to gains made 12 months after or 3 years before investment.

- EIS shares qualify for BPR and so would get IHT relief provided shares are held for more than 2 years at death.

SEED ENTERPRISE INVESTMENT SCHEME (SEIS)

SEIS is designed for start-ups in their early years whereas EIS is for slightly more established companies. For this reason, SEIS offers a more generous tax relief to compensate for the increased risk that comes with investing in smaller seed businesses.

- The income tax relief is 50% on a maximum investment of £100,000 per tax year when an investor buys newly issued shares. This is usually claimed back if they sell the shares within three years unless the holder was to sell them to their spouse, or they die.

- Tax relief is provided in the form of a tax credit to set against the investor’s overall income tax liability in the tax year. The amount of the tax credit cannot, therefore, exceed their total income tax liability for that tax year.

- Tax is payable on any dividends at the investor’s marginal rate.

- You won’t have to pay any capital gains tax on gains from investments in SEIS as long as you have held them for the minimum holding period of three years. But if your SEIS investments make a loss, you can get loss relief per company if that company fails.

- CGT deferral of 50% applies to gains reinvested into SEIS. The maximum gain reduction is £100,000 per annum. The gain must arise in the tax year in respect of which SEIS income tax relief is given (i.e. either in the tax year of investment or the preceding tax year if a carry back claim is made).

- SEIS shares qualify for BPR and so would get IHT relief provided shares are held for more than 2 years at death.

It’s important to note that these types of investments all have an extremely high-risk profile and investors have to be prepared to risk all of their capital in each EIS-qualifying company they invest in.

WHAT HAPPENS IF AN INVESTOR WANTS THEIR MONEY BACK?

Don’t be fooled by the seemingly short investment time requirements on these products. Even though VCT, EIS and SEIS products all offer five years or less minimum term, the reality is that exiting these types of investments can be extremely challenging. As the funds are tied up in fledgling businesses, the cash flow and liquidity of these types of shares are notoriously low making the time it takes investors to get their money back after the required term much longer than people think. So, make sure clients are willing to have their funds tied up for longer than it says on the tin.

Evergreen investments won’t be automatically sold immediately after the holding period.

Additionally, as the initial tax reliefs are only available on subscription of new shares, the second-hand markets for these products are pretty much non-existent as they don’t offer the same incentives to second-hand buyers, making them difficult to dispose of outside of the usual routes.