Sharing the results of the latest IFA Magazine reader survey, carried out in conjunction with Brooks Macdonald, we report on the criteria which underpin adviser due diligence when it comes to recommending multi-asset funds or other outsourced investment solutions.

In September, in conjunction with investment manager Brooks Macdonald, IFA Magazine carried out its latest reader survey*. The purpose was to discover which factors lie behind advisers’ decisions to recommend multi-asset funds as well as other outsourced investment solutions for use within their clients’ investment portfolios to give diversified exposure to a broad asset allocation and range of markets. So, what did you tell us?

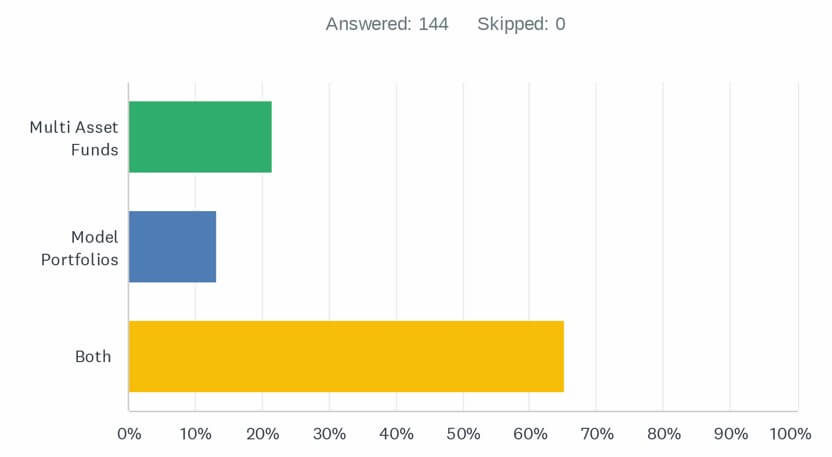

Firstly, it’s clear that outsourced solutions are already proving a popular choice with readers. Almost two thirds of respondents (65%) told us that they are recommending either multi asset funds or managed portfolio solutions (MPS) to their clients (see fig 1). Whilst over 73% said that their use of such solutions was likely to stay the same in future.

Investment due diligence

What about the use of external rating agencies (such as RSMR, Square Mile, Defaqto Diamond etc) as a tool in helping advisers to research and analyse which funds or strategies are likely to be most appropriate for use with their clients? With regard to this, responses were split with 56.3% preferring to use external research and analysis services whilst 43.7% do not.

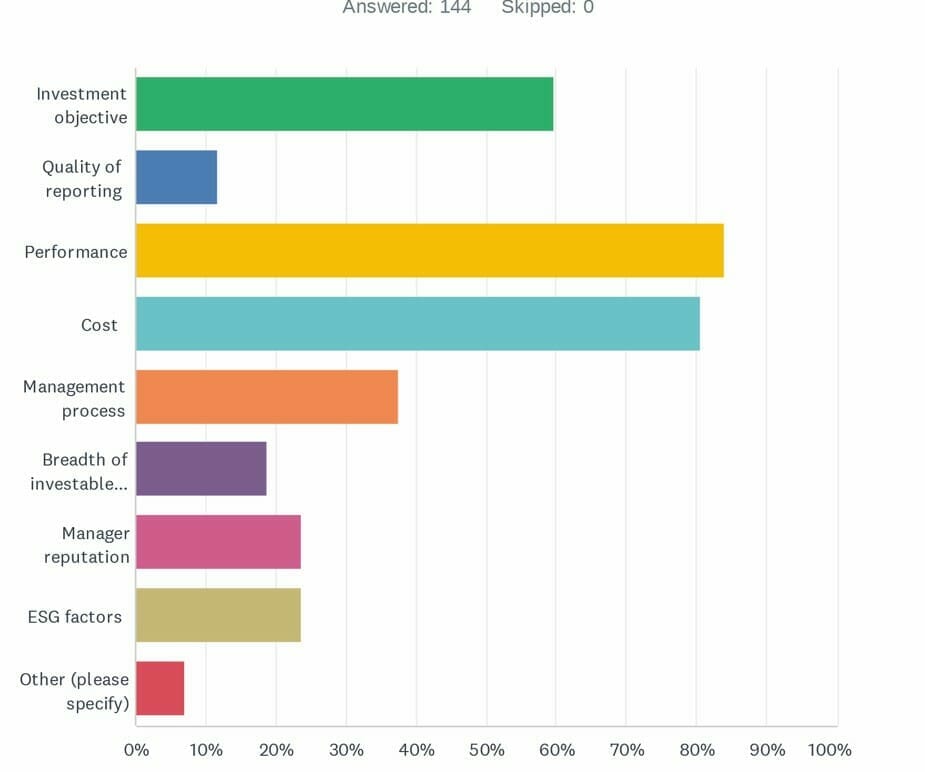

When it came to identifying which factors were of the highest importance to advisers when selecting appropriate investment solutions for recommendation to clients, there were few surprises as fig 2 clearly shows.

We asked advisers to rank their top three categories affecting their decisions when selecting investment solutions for clients. Top of the list was ‘performance’ with 84% of respondents rating it in their top three, ‘cost’ came a close second, with 80% selecting it, and ‘investment objective’ grabbed third place with 60% of the vote. Other criteria which are on our respondents’ radar were the fund or strategy’s underlying ‘management process’ which was selected by 37.5% of respondents, ‘ESG factors’ (23.6%) and ‘breadth of investment universe’ (18.7%). Quality of reporting was also a factor but only for a relatively small tranche of respondents (11.8%).

When it comes to recommending outsourced solutions, cost which was the second out of the top three categories identified, is always a significant factor as it impacts the total return available for the underlying client. Hence, it was little surprise that 98% of our survey respondents confirmed to us that in their view investment solutions costs are either ‘very’ or ‘somewhat’ important when it comes to making client recommendations.

Clarity on cost

However, with so many different measures of cost still being used, which are the ones that advisers most relate to in order to demonstrate the true annual cost of a fund? Half of the readers surveyed (50%) told us that it was the OCF (ongoing charges figure) which was most relevant to them, whilst 29.2% reported that it was MiFID II total cost and 20.8% chose the AMC (annual management charge). Whether OCFs provide a useful indication of the cost of an investment solution, the verdict is clear with 84.7% of respondents saying “Yes” it does.

During the summer, Brooks Macdonald announced reductions to the Annual Management Charges (AMC) on both their Cornelian Risk Managed Fund Range and the Cornelian Risk Managed Passive Range. The changes took effect from 1 July 2022, with no impact on the underlying investment process or how the funds are managed.

For Robin Eggar, Managing Director, Head of UK Investment Management at Brooks Macdonald, this reduction in cost was a significant step forward in increasing the value for money which the investment manager is able to deliver for clients as he comments: “We’re constantly working towards our ambition to deliver robust investment performance alongside outstanding service for our clients and intermediaries. We understand the importance of cost as a key consideration in the advice process and that’s why we were so pleased to announce the reductions to the Cornelian Risk Managed Fund ranges back in the summer.”

The active and/or passive debate

Finally, we were also interested to hear readers’ views on the age-old discussion as to the merits of choosing active investment management and/or opting for passive strategies. When it comes to using active investment solutions, 20.8% of respondents told us that this was their preferred approach, with just 5.6% favouring passive strategies. The vast majority (73.6%) of our survey respondents told us that they recommend the use of a combination of both active and passive approaches in their clients’ portfolios to help them to achieve their investment goals. Such views appear to be well entrenched with our respondents, with 73% reporting that these approaches are likely to ‘stay the same’ in future.

In rounding off the survey, we asked our readers to tell us which product developments they would like to see from investment solutions’ providers over the next 12-18 months. From the responses we received, it appears that the following are amongst the requirements which feature high on advisers’ lists:

- Wider choice of sustainable/ESG-focused MPS strategies and multi-asset funds

- Further decreases in costs and greater transparency of charges

- Improved platform availability

- Enhanced reporting, technical updates and service

About the Cornelian Risk Managed Funds

The two Cornelian Risk Managed Fund ranges consist of eleven funds across five different risk levels – providing choice and flexibility when selecting a multi-asset investment solution. The funds are widely available on all major platforms.

For more information, please click here

*Survey details

The IFA Magazine survey entitled “Understanding multi-asset funds” was carried out online with readers between 6th – 9th September 2022. There were 144 respondents.